South Sudan's English Daily Newspaper

"We Dare where others fear"

By Awan Achiek

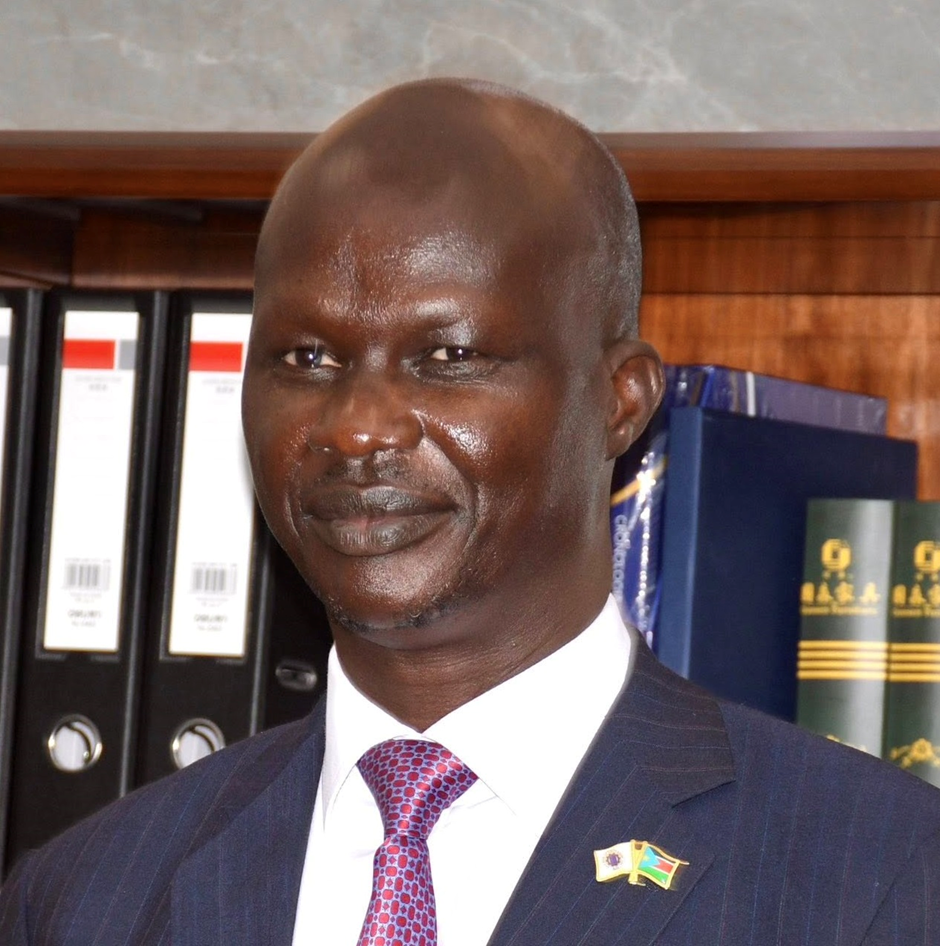

The newly appointed Governor of the Bank of South Sudan, Dr. Addis Ababa Othow, has reiterated the bank’s dedication to curbing inflation and ensuring price stability in the market.

South Sudan is grappling with a severe crisis as its currency has sharply depreciated against the US dollar.

The fall of the South Sudanese pound has plunged the nation deeper into inflation and widespread hardship.

Reports from black market vendors on Thursday indicated a staggering exchange rate of 585,000 South Sudanese pounds for one US dollar, compared to 459,000 at the Central Bank.

In his key remarks during his swearing-in at the State House in Juba on Wednesday, Dr. Othow emphasised the significance of price stability in enhancing the economy.

“I am quite sure that our principal mandate is to ensure that we maintain price stability while also promoting sustainable growth,” Othow told SSBC on Wednesday.

Dr. Othow promised to work with the Ministry of Finance to ensure timely payment of salaries.

“I am committed to working closely with the minister of finance and all stakeholders to ensure that we streamline our efforts and collectively bring about timely salary payments,” he said.

He pledged to lead the bank with transparency and accountability, emphasising his commitment to upholding the central bank’s mandate.

Citizens have decried the skyrocketing prices of basic commodities, such as food, due to the deteriorating economic situation in the country.

South Sudan depends significantly on essential commodities imported from neighbouring Kenya, Sudan, and Uganda.

For his part, Dr. Marial Dongrin Ater, Minister of Finance and Planning, said the shortage of South Sudanese pounds has crippled the economy, plunging the government into uncertainty.

“The major challenge you will face is how to address the cash shortage in the economy,” Dr. Marial said.

He stated that the cash crisis has affected government service delivery and salary payments.

“We have been able to pay salaries for the past seven months without fail, but that money goes into the account without cash. So, getting cash is the biggest problem,” he said.

He disclosed that the ministry has put in place policies to boost economic recovery.